In that movie, Prinze' character counseled a friend in L.A. whom he had asked to visit him in New York. The friend replied that he couldn't because of his fear of flying.

"What are you afraid of, dying in a plane crash?" I recall Prinze' character asking.

"Of course," replied the friend.

"No problem! Sit in an exit row next to the window. Look out the window. If the plane starts to crash, wait 'til it's like, three feet above the ground and jump out!"

I refer to these as "Exit Row Strategies". They get a few laughs when uttered by a comedian, but they shouldn't be part of retirement planning. The best-known Exit Row Strategy is market timing. Invest in stock markets and sell before a major market decline. Tons of research shows that market timing doesn't work – people tend to jump out (or in) at the worst time. (Here's Morningstar's take.)

Similar advice says, "Don't buy an annuity until you see your invested retirement savings fall in value." In other words, bet it all on the market. If that doesn't work out, dive out the window onto a soft, cushy annuity just before your portfolio hits the ground.

In my last post, The Whoosh! of Exponential Retirement, I described the nature of exponential change. It can seem like nothing changes much for a very long time, only to have events whoosh! by us at the end. The higher the exponent, the faster the growth and the greater the whoosh! effect – the effect of 3% annual inflation doesn't whoosh! nearly as loudly as the effect of 8% annual portfolio growth when we save for retirement.

[Tweet this]Retirement risk happens fast. Don't count on having time to jump out its way.

Here's a description of how saving for retirement, portfolio depletion and bankruptcy can feel. Imagine you're standing on a station platform in Omaha and you see a train in the distance. Actually, you see a dot on the horizon at the end of a very long, straight stretch of track. You watch for what seems like forever, but the dot doesn't get much bigger. After a long period of waiting, the train finally becomes bigger and bigger and suddenly it passes you on the platform unbelievably fast. (No problem – not your train.)

Seemingly out of nowhere, you are bankrupt. Or, you met your retirement savings goals in the last decade before retiring. (Remember from my last post that exponential change can be bad or good.)

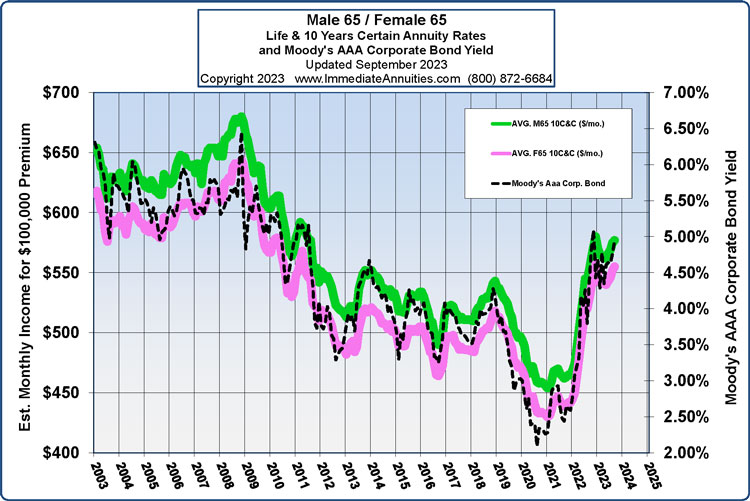

How are Exit Row Strategies risky in real life? Let's imagine that you retire in 2005 with $500,000 saved and are debating whether to annuitize some of it. You can purchase a life annuity that pays $625 monthly ($7,500 annually) per $100,000 contract, based on the chart below from immediateannuities.com, so if you annuitize the entire $500,000, you could receive $37,500 annually for as long as you live.

You figure you need $25,000 to support your lifestyle, so you think you have lots of margin for error and you invest it all in stocks. If and when your portfolio declines to $333,333, you plan to buy an annuity with a 7.5% payout that pays the $25,000 minimum you figure you need in the worst case.

(Note that you are guessing that the payout will still be 7.5% when you buy sometime in the future. This illustrates another risk in planning to buy immediate annuities in the future: annuity payouts are based on interest rates and both are impossible to predict, as is how much principal you will have on hand to purchase them. Annuity payouts increased from 2005 to 2009, but they declined dramatically after that. Also, annuities get cheaper as you age, so your future annuity payout will also depend on when you eventually decide to buy. That's a lot of guessing.)

Unexpected (by anyone), the Great Recession hits two years later and the market falls 50% in just 18 months.

Sadly, your portfolio declines nearly 50% to $250,000 over the next 18 months and you can now only purchase about $18,750 of guaranteed annual income at 2007 annuity payout rates. On the positive side, annuity payouts increased 8% from 2005 (about 7.1%) to 2009 (8.1%), so you could actually buy $20,250 of annual income. But, that's still 19% less than you need.

Your losses whooshed! right by before you could jump out the exit window. Doesn't that $37,500 of guaranteed annual income look pretty good now? Rather than planning a last minute bail-out, a more prudent move might have been to nail down the $25,000 income you needed when you could in 2005 (nail down a floor, get it?) with $333,333 of your savings and take a shot at upside with the remaining $166,667.

"But wait," I can hear risk-takers protesting, "I can just wait until the market recovers!"

Maybe, and I would guess it probably will, but as I explained in Even Your Portfolio Heals More Slowly as You Get Older, recovering from bear market losses while you are still working, earning income, and buying stocks at discounted prices is one thing. Recovering those losses after you start spending in retirement using stocks that have fallen in value and having no income to buy discounted stocks is quite another. This analysis is all about the income side and totally ignores the risk that you will have unforeseen major expenses just when your portfolio has declined.

Exit Row Strategies are a lot harder to implement in a crisis than you might think and, by their nature, they are always executed in a crisis.

Some recent work by Wade Pfau and by Barry and Stephen Sacks regarding the use of reverse mortgages to fund retirement is the opposite of an Exit Row Strategy. The studies suggest that applying for a reverse mortgage early in retirement has significant benefits over using home equity as a last resort late in retirement. (Setting up the mortgage early makes perfect sense to me. Using it to mitigate sequence risk is a step farther than I am willing to go at present.)

The train analogy isn't perfect, of course, because the train isn't actually accelerating exponentially, it just feels that way to a distant observer. But, it loosely ties back to the speed of the approaching ground for Freddie's friend and to an old baseball joke. ("The ball kept getting bigger and bigger. . . and then it hit me. . .")

This post isn't about reverse mortgages, investing or annuities, though, it's about taking risk that you believe you can foresee and therefore somehow deftly avoid.

Life comes at us fast.

We can't depend on having time to jump out of its way at the last second.

Life comes at us fast.

We can't depend on having time to jump out of its way at the last second.

In a USA Today interview and a paper, It's Time to Retire Ruin (Probabilities), Dr. Moshe Milevsky explains why "probability of ruin" isn't a good retirement management tool. I wrote about this in Time to Retire Probability of Ruin. (Don't let the similarity of titles fool you, Milevsky does a much better job.)

Now that you paid off your mortgage before retiring, are you ready for a new one? Check out my next post, The Mortgage is Dead; Long Live the (Reverse) Mortgage.

Now that you paid off your mortgage before retiring, are you ready for a new one? Check out my next post, The Mortgage is Dead; Long Live the (Reverse) Mortgage.